Dublin, Oct. 14, 2024 (GLOBE NEWSWIRE) — The “Cards and Payments Market Opportunities and Strategies to 2033” report has been added to ResearchAndMarkets.com offerings.

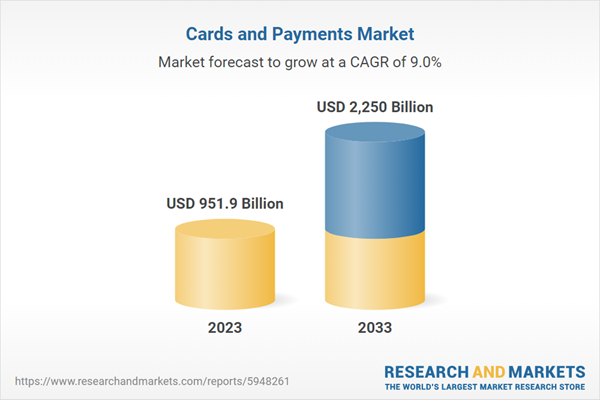

The global cards and payments market will reach a value of nearly USD 951.85 billion in 2023, growing at a compound annual growth rate (CAGR) of 9.48% from 2018. The market is expected to grow from 951.85 billion in 2023 to $1.45 trillion in 2028 at a rate of 8.79%. The market is expected to grow at a CAGR of 9.25% from 2028 and reach $2.25 trillion in 2033.

Growth over the historical period resulted from increased adoption of EMV technology, increased consumer preference for credit cards due to additional benefits, and increased Internet penetration. Factors that have negatively affected growth historically include the lack of security in digital payments. Going forward, growing e-commerce penetration, increasing government support, growth in digital platforms, increasing awareness of e-payments, and increasing demand for smartphones will drive the market. Factors that could hinder the growth of the cards and payments market in the future include an increase in credit card fraud.

The cards and payments market is segmented by type into cards and payments. The payments market was the largest segment of the card and payment market segmented by type, accounting for 68.03% or USD 647.55 billion of the total in 2023. Going forward, the payments segment is expected to be the segment with the most fast growing card and payment market. segmented by type, at a CAGR of 9.25% during 2023-2028.

The card and payment market is segmented by type of institution into banking institutions and non-banking institutions. The banking institutions market was the largest segment of the cards and payments market, segmented by institution type, accounting for 70.95% or $675.3 billion of the total in 2023. Going forward, the non-banking institutions segment is expected to be the with the fastest growth in the card and payment market segmented by type of institution, at a CAGR of 9.65% in the period 2023-2028.

The card and payment market is segmented by application into banking, financial services and insurance, healthcare, IT and telecommunications, retail and e-commerce, media and entertainment, transportation and other applications. The banking, financial services and insurance market was the largest segment of the card and payment market segmented by application, accounting for 23.29% or $221.67 billion of the total in 2023. Going forward, the retail and e-commerce segment is expected to be the fastest growing segment of the cards and payments market segmented by application at a CAGR of 10.23% during 2023-2028.

Asia-Pacific was the largest region in the card and payment market, accounting for 38.00% or USD 361.74 billion of the total in 2023. It was followed by Western Europe, North America, and then the other regions. Going forward, the fastest growing regions in the card and payment market will be Africa and Asia-Pacific, where growth will be at a CAGR of 16.83% and 11.15%, respectively. These will be followed by the Middle East and Eastern Europe where the markets are expected to grow at CAGRs of 8.70% and 8.57% respectively.

The global card and payment market is quite fragmented, with a large number of small players operating in the market. The top ten competitors in the market accounted for 19.7% of the total market in 2023. American Express Company was the largest competitor with a 5.7% market share, followed by PayPal Holdings Inc with 2.8%, Capital One Financial Corporation with 2.7%, Visa Inc. with 2.7%, Mastercard Incorporated with 1.8%, Citigroup Inc. by 1%, Bank of America Corporation by 0.9%, Wells Fargo & Company by 0.8%, US BanCorp. by 0.6% and Barclays plc by 0.6%.

Strategies based on market trends for the card and payments market include an increased focus on credit card platforms, the use of artificial intelligence (AI) to prevent fraud in the payments sector, the development of digital wallets and contactless payment technology to aid convenience , the technological release. advanced payment devices and new product launches with a focus on virtual cards and payment network integration.

Strategies adopted by card and payment market players include focusing on strengthening merchant business with payments through innovative payment products and solutions, strategic acquisitions, and strengthening P2P, merchant and B2B payment services.

To seize opportunities, the analyst recommends card and payment companies focus on credit card platforms to drive growth, focus on AI-based fraud prevention to enhance security, focus on digital wallet and adoption contactless payments, to focus on technologically advanced payments. devices to strengthen the market position, focus on product launches to strengthen the market position, focus on the card market segment, focus on the non-banking segment, focus on the prepaid card segment, expand into emerging markets, offer offers at competitive prices, attending trade shows and events and focusing on targeted strategies for various applications.

Top opportunities

- The top opportunities in the cards and payments market segmented by type will emerge in the payments segment, which will earn $360.37 billion in global annual sales by 2028.

- The top opportunities in the card and payments market by institution type will emerge in the banking institutions segment, which will earn $336.59 billion in global annual sales by 2028.

- The top opportunities in the card and payment by app market will emerge in the banking, financial services, and insurance segment, which will gain $130.18 billion in global annual sales by 2028. The size of the card and payment market will gain the most in China at $94.42 billion. .

Key Attributes:

| The report attribute | Details |

| No. of pages | 359 |

| Forecast period | 2023 – 2033 |

| Estimated market value (USD) in 2023 | 951.9 billion dollars |

| Estimated market value (USD) by 2033 | 2250 billion dollars |

| Compound annual growth rate | 9.0% |

| Regions covered | overall |

Major market trends

- Increased focus on credit card platforms

- Using artificial intelligence (AI) to prevent fraud in the payments sector

- Development of digital wallets and contactless payment technology to facilitate convenience

- Launch of technologically advanced payment devices

- New product launches with focus on virtual cards and integration of payment networks

Customer information

- Consumers prioritize credit card rewards when choosing a new credit card

- Digital wallets are affecting spending habits and shaping the way Americans shop

- Card use increased slightly in retail payments

- Changing consumer behavior towards new payment methods

- Most consumers prefer to use debit cards as their primary payment method

- Customer behavior towards payment options

- Increased consumer preference for card payments to track spending

- The debit card is the most used, followed by credit cards

Competitive landscape and company profiles

- American Express Company

- Company overview

- Products and Services

- Business strategy

- Financial overview

- PayPal Holdings Inc

- Capital One Financial Corporation

- Visa Inc

- Mastercard Incorporated

Other major and innovative companies

- Citigroup Inc

- Bank of America Corporation

- Wells Fargo & Company

- US BanCorp

- Barclays Plc

- JPMorgan Chase & Co

- HSBC Holdings Plc

- Agricultural Bank of China

- Financial synchronization

- USAA

- PNC Financial Services Inc. Group

- Klarna Inc

- Goldman Sachs Group Inc

- Discover Financial Services

- Worldline Sa

For more information on this report, visit https://www.researchandmarkets.com/r/5r4u1

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We bring you the latest data on international and regional markets, key industries, top companies, new products and the latest trends.

-

The card and payment market

#Cards #Payments #Market #Opportunities #Strategies